European Credit risk is climbing very fast. Portugal, Ireland, Spain, Italy and UK are seeing their risk in a very, very unconfortable position...

European Credit risk is climbing very fast. Portugal, Ireland, Spain, Italy and UK are seeing their risk in a very, very unconfortable position...Who is taking care of the mess if anybody defaults ??? And the € ???

WIZ

European Credit risk is climbing very fast. Portugal, Ireland, Spain, Italy and UK are seeing their risk in a very, very unconfortable position...

European Credit risk is climbing very fast. Portugal, Ireland, Spain, Italy and UK are seeing their risk in a very, very unconfortable position...

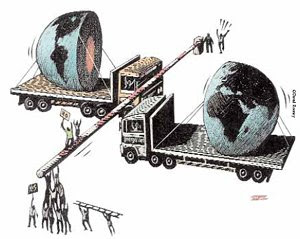

The definition of Protectionism is : The economic policy of restaining trade between nations, through methods such as tariffs on imported goods, restrictive quotas, and a variety of other restrictive government regulations to discourage imports and prevent foreign take-over of local markets and companies.

The definition of Protectionism is : The economic policy of restaining trade between nations, through methods such as tariffs on imported goods, restrictive quotas, and a variety of other restrictive government regulations to discourage imports and prevent foreign take-over of local markets and companies. The Treasuries Yield curve steepened sharply as the Long term yields rose ahead of US Government borrowing while the short end is anchored by the near zero Fed-funds rates...

The Treasuries Yield curve steepened sharply as the Long term yields rose ahead of US Government borrowing while the short end is anchored by the near zero Fed-funds rates...

| Blog: |

| EL COMITE DE CAN ROCH |

Topics: |

| FINANCE, MARKETS, OTHER |