Courtesy of DCSHORT

Courtesy of DCSHORTWIZ

George Soros Speech

Institute of International Finance, Vienna, Austria

June 10, 2010

In the week following the bankruptcy of Lehman Brothers on September 15, 2008 - global financial markets actually broke down and by the end of the week they had to be put on artificial life support. The life support consisted of substituting sovereign credit for the credit of financial institutions which ceased to be acceptable to counter parties.

As Mervyn King of the Bank of England brilliantly explained, the authorities had to do in the short-term the exact opposite of what was needed in the long-term: they had to pump in a lot of credit to make up for the credit that disappeared and thereby reinforce the excess credit and leverage that had caused the crisis in the first place. Only in the longer term, when the crisis had subsided, could they drain the credit and reestablish macro-economic balance. This required a delicate two phase maneuver just as when a car is skidding, first you have to turn the car into the direction of the skid and only when you have regained control can you correct course.

The first phase of the maneuver has been successfully accomplished - a collapse has been averted. In retrospect, the temporary breakdown of the financial system seems like a bad dream. There are people in the financial institutions that survived who would like nothing better than to forget it and carry on with business as usual. This was evident in their massive lobbying effort to protect their interests in the Financial Reform Act that just came out of Congress. But the collapse of the financial system as we know it is real and the crisis is far from over.

Indeed, we have just entered Act II of the drama, when financial markets started losing confidence in the credibility of sovereign debt. Greece and the euro have taken center stage but the effects are liable to be felt worldwide. Doubts about sovereign credit are forcing reductions in budget deficits at a time when the banks and the economy may not be strong enough to permit the pursuit of fiscal rectitude. We find ourselves in a situation eerily reminiscent of the 1930's. Keynes has taught us that budget deficits are essential for counter cyclical policies yet many governments have to reduce them under pressure from financial markets. This is liable to push the global economy into a double dip.

It is important to realize that the crisis in which we find ourselves is not just a market failure but also a regulatory failure and even more importantly a failure of the prevailing dogma about financial markets. I have in mind the Efficient Market Hypothesis and Rational Expectation Theory. These economic theories guided, or more exactly misguided, both the regulators and the financial engineers who designed the derivatives and other synthetic financial instruments and quantitative risk management systems which have played such an important part in the collapse. To gain a proper understanding of the current situation and how we got to where we are, we need to go back to basics and reexamine the foundation of economic theory.

I have developed an alternative theory about financial markets which asserts that financial markets do not necessarily tend towards equilibrium; they can just as easily produce asset bubbles. Nor are markets capable of correcting their own excesses. Keeping asset bubbles within bounds have to be an objective of public policy. I propounded this theory in my first book, The Alchemy of Finance, in 1987. It was generally dismissed at the time but the current financial crisis has proven, not necessarily its validity, but certainly its superiority to the prevailing dogma.

Let me briefly recapitulate my theory for those who are not familiar with it. It can be summed up in two propositions. First, financial markets, far from accurately reflecting all the available knowledge, always provide a distorted view of reality. This is the principle of fallibility. The degree of distortion may vary from time to time. Sometimes it's quite insignificant, at other times it is quite pronounced. When there is a significant divergence between market prices and the underlying reality I speak of far from equilibrium conditions. That is where we are now.

Second, financial markets do not play a purely passive role; they can also affect the so called fundamentals they are supposed to reflect. These two functions that financial markets perform work in opposite directions. In the passive or cognitive function the fundamentals are supposed to determine market prices. In the active or manipulative function market prices find ways of influencing the fundamentals. When both functions operate at the same time they interfere with each other. The supposedly independent variable of one function is the dependent variable of the other so that neither function has a truly independent variable. As a result neither market prices nor the underlying reality is fully determined. Both suffer from an element of uncertainty that cannot be quantified. I call the interaction between the two functions reflexivity. Frank Knight recognized and explicated this element of unquantifiable uncertainty in a book published in 1921 but the Efficient Market Hypothesis and Rational Expectation Theory have deliberately ignored it. That is what made them so misleading.

Reflexivity sets up a feedback loop between market valuations and the so-called fundamentals which are being valued. The feedback can be either positive or negative. Negative feedback brings market prices and the underlying reality closer together. In other words, negative feedback is self-correcting. It can go on forever and if the underlying reality remains unchanged it may eventually lead to an equilibrium in which market prices accurately reflect the fundamentals. By contrast, a positive feedback is self-reinforcing. It cannot go on forever because eventually market prices would become so far removed from reality that market participants would have to recognize them as unrealistic. When that tipping point is reached, the process becomes self-reinforcing in the opposite direction. That is how financial markets produce boom-bust phenomena or bubbles. Bubbles are not the only manifestations of reflexivity but they are the most spectacular.

In my interpretation equilibrium, which is the central case in economic theory, turns out to be a limiting case where negative feedback is carried to its ultimate limit. Positive feedback has been largely assumed away by the prevailing dogma and it deserves a lot more attention.

I have developed a rudimentary theory of bubbles along these lines. Every bubble has two components: an underlying trend that prevails in reality and a misconception relating to that trend. When a positive feedback develops between the trend and the misconception a boom-bust process is set in motion. The process is liable to be tested by negative feedback along the way and if it is strong enough to survive these tests, both the trend and the misconception will be reinforced. Eventually, market expectations become so far removed from reality that people are forced to recognize that a misconception is involved. A twilight period ensues during which doubts grow and more and more people lose faith but the prevailing trend is sustained by inertia. As Chuck Prince former head of Citigroup said, "As long as the music is playing you've got to get up and dance. We are still dancing." Eventually a tipping point is reached when the trend is reversed; it then becomes self-reinforcing in the opposite direction.

Typically bubbles have an asymmetric shape. The boom is long and slow to start. It accelerates gradually until it flattens out again during the twilight period. The bust is short and steep because it involves the forced liquidation of unsound positions. Disillusionment turns into panic, reaching its climax in a financial crisis.

The simplest case of a purely financial bubble can be found in real estate. The trend that precipitates it is the availability of credit; the misconception that continues to recur in various forms is that the value of the collateral is independent of the availability of credit. As a matter of fact, the relationship is reflexive. When credit becomes cheaper activity picks up and real estate values rise. There are fewer defaults, credit performance improves, and lending standards are relaxed. So at the height of the boom, the amount of credit outstanding is at its peak and a reversal precipitates false liquidation, depressing real estate values.

The bubble that led to the current financial crisis is much more complicated. The collapse of the sub-prime bubble in 2007 set off a chain reaction, much as an ordinary bomb sets off a nuclear explosion. I call it a super-bubble. It has developed over a longer period of time and it is composed of a number of simpler bubbles. What makes the super-bubble so interesting is the role that the smaller bubbles have played in its development.

The prevailing trend in the super-bubble was the ever increasing use of credit and leverage. The prevailing misconception was the believe that financial markets are self-correcting and should be left to their own devices. President Reagan called it the "magic of the marketplace" and I call it market fundamentalism. It became the dominant creed in the 1980s. Since market fundamentalism was based on false premises its adoption led to a series of financial crises. Each time, the authorities intervened, merged away, or otherwise took care of the failing financial institutions, and applied monetary and fiscal stimuli to protect the economy. These measures reinforced the prevailing trend of ever increasing credit and leverage and as long as they worked they also reinforced the prevailing misconception that markets can be safely left to their own devices. The intervention of the authorities is generally recognized as creating amoral hazard; more accurately it served as a successful test of a false belief, thereby inflating the super-bubble even further.

It should be emphasized that my theories of bubbles cannot predict whether a test will be successful or not. This holds for ordinary bubbles as well as the super-bubble. For instance I thought the emerging market crisis of 1997-1998 would constitute the tipping point for the super-bubble, but I was wrong. The authorities managed to save the system and the super-bubble continued growing. That made the bust that eventually came in 2007-2008 all the more devastating.

What are the implications of my theory for the regulation of the financial system?

First and foremost, since markets are bubble-prone, the financial authorities have to accept responsibility for preventing bubbles from growing too big. Alan Greenspan and other regulators have expressly refused to accept that responsibility. If markets can't recognize bubbles, Greenspan argued, neither can regulators--and he was right. Nevertheless, the financial authorities have to accept the assignment, knowing full well that they will not be able to meet it without making mistakes. They will, however, have the benefit of receiving feedback from the markets, which will tell them whether they have done too much or too little. They can then correct their mistakes.

Second, in order to control asset bubbles it is not enough to control the money supply; you must also control the availability of credit. This cannot be done by using only monetary tools; you must also use credit controls. The best-known tools are margin requirements and minimum capital requirements. Currently they are fixed irrespective of the market's mood, because markets are not supposed to have moods. Yet they do, and the financial authorities need to vary margin and minimum capital requirements in order to control asset bubbles.

Regulators may also have to invent new tools or revive others that have fallen into disuse. For instance, in my early days in finance, many years ago, central banks used to instruct commercial banks to limit their lending to a particular sector of the economy, such as real estate or consumer loans, because they felt that the sector was overheating. Market fundamentalists consider that kind of intervention unacceptable but they are wrong. When our central banks used to do it we had no financial crises to speak of. The Chinese authorities do it today, and they have much better control over their banking system. The deposits that Chinese commercial banks have to maintain at the People's Bank of China were increased seventeen times during the boom, and when the authorities reversed course the banks obeyed them with alacrity.

Third, since markets are potentially unstable, there are systemic risks in addition to the risks affecting individual market participants. Participants may ignore these systemic risks in the belief that they can always dispose of their positions, but regulators cannot ignore them because if too many participants are on the same side, positions cannot be liquidated without causing a discontinuity or a collapse. They have to monitor the positions of participants in order to detect potential imbalances. That means that the positions of all major market participants, including hedge funds and sovereign wealth funds, need to be monitored. The drafters of the Basel Accords made a mistake when they gave securities held by banks substantially lower risk ratings than regular loans: they ignored the systemic risks attached to concentrated positions in securities. This was an important factor aggravating the crisis. It has to be corrected by raising the risk ratings of securities held by banks. That will probably discourage loans, which is not such a bad thing.

Fourth, derivatives and synthetic financial instruments perform many useful functions but they also carry hidden dangers. For instance, the securitization of mortgages was supposed to reduce risk thru geographical diversification. In fact it introduced a new risk by separating the interest of the agents from the interest of the owners. Regulators need to fully understand how these instruments work before they allow them to be used and they ought to impose restrictions guard against those hidden dangers. For instance, agents packaging mortgages into securities ought to be obliged to retain sufficient ownership to guard against the agency problem.

Credit default swaps (CDS) are particularly dangerous they allow people to buy insurance on the survival of a company or a country while handing them a license to kill. CDS ought to be available to buyers only to the extent that they have a legitimate insurable interest. Generally speaking, derivatives ought to be registered with a regulatory agency just as regular securities have to be registered with the SEC or its equivalent. Derivatives traded on exchanges would be registered as a class; those traded over-the-counter would have to be registered individually. This would provide a powerful inducement to use exchange traded derivatives whenever possible.

Finally, we must recognize that financial markets evolve in a one-directional, nonreversible manner. The financial authorities, in carrying out their duty of preventing the system from collapsing, have extended an implicit guarantee to all institutions that are "too big to fail." Now they cannot credibly withdraw that guarantee. Therefore, they must impose regulations that will ensure that the guarantee will not be invoked. Too-big-to-fail banks must use less leverage and accept various restrictions on how they invest the depositors' money. Deposits should not be used to finance proprietary trading. But regulators have to go even further. They must regulate the compensation packages of proprietary traders to ensure that risks and rewards are properly aligned. This may push proprietary traders out of banks into hedge funds where they properly belong. Just as oil tankers are compartmentalized in order to keep them stable, there ought to be firewalls between different markets. It is probably impractical to separate investment banking from commercial banking as the Glass-Steagall Act of 1933 did. But there have to be internal compartments keeping proprietary trading in various markets separate from each other. Some banks that have come to occupy quasi-monopolistic positions may have to be broken up.

While I have a high degree of conviction on these five points, there are many questions to which my theory does not provide an unequivocal answer. For instance, is a high degree of liquidity always desirable? To what extent should securities be marked to market? Many answers that followed automatically from the Efficient Market Hypothesis need to be reexamined.

It is clear that the reforms currently under consideration do not fully satisfy the five points I have made but I want to emphasize that these five points apply only in the long run. As Mervyn King explained the authorities had to do in the short run the exact opposite of what was required in the long run. And as I said earlier the financial crisis is far from over. We have just ended Act Two. The euro has taken center stage and Germany has become the lead actor. The European authorities face a daunting task: they must help the countries that have fallen far behind the Maastricht criteria to regain their equilibrium while they must also correct the deficinies of the Maastricht Treaty which have allowed the imbalances to develop. The euro is in what I call a far-from-equilibrium situation. But I prefer to discuss this subject in Germany, which is the lead actor, and I plan to do so at the Humboldt University in Berlin on June 23rd. I hope you will forgive me if I avoid the subject until then.

WIZ

THE GAME OVER IS GETTING CLOSE... Lo siento chicos pero parece que la "FIESTA" está acercandose a su final ...

THE GAME OVER IS GETTING CLOSE... Lo siento chicos pero parece que la "FIESTA" está acercandose a su final ... “Finance ministers in the eurozone might argue that they acted to save the euro, but in reality they acted to save national bond markets – and the euro is the fall guy,” says Steve Barrow at Standard Bank. (via MR)

“Finance ministers in the eurozone might argue that they acted to save the euro, but in reality they acted to save national bond markets – and the euro is the fall guy,” says Steve Barrow at Standard Bank. (via MR) Courtesy of David Rosenberg.

Courtesy of David Rosenberg.Remember the TED Spread? He’s back:

On Tuesday Portuguese 10-year bond yields rose to 4.65 per cent, up 5 basis points on the day, heading once again towards record highs of 4.77 per cent that it hit in early February.

In recent days it has also become more expensive to buy credit default protection against short-dated Portuguese government bonds rather than long-dated ones. Greece is the only other country in the Eurozone where this is also the case.This anomaly in credit markets – known as a curve inversion – is an indication of market expectations of financial stress and highlights rising concern in markets about contagion from Greece"European Soverign CDS continues to trade worse the last couple of days with all the gains from the Monday announcement of the Greece rescue package evaporated. At its recent peak, Greece 5yr CDS was trading around 440 bps which subsequently recovered to about 375 bps after details of the European aid was released. It is currently trading around 430 bps. The higher the premium, the higher the market’s perception of a default.

Separately, there appears to be some contagion with Portugal and Spain CDS both spiking on fears that these countries are next in line after Greece. Here is where they are most recently quoted:

| CDS | 5YR | 10YR | 5Y1D | 5Y1W |

| —————— | ———— | ———- | —— | —— |

| AUSTRIA (100) | 57/61 | 62/66 | 2 | -2 |

| BELGIUM (25) | 59/63 | 64/68 | 2 | -1 |

| DENMARK (25) | 34/38 | 39/43 | 1 | 1 |

| FINLAND (25) | 25/28 | 28/32 | 1 | 2 |

| FRANCE (25) | 52/55 | 57/61 | 3 | -1 |

| GERMANY (25) | 32/34 | 36/39 | 2 | 1 |

| GREECE (100) | 420/440 | 360/390 | 0 | -10 |

| IRELAND (100) | 149/155 | 152/162 | 0 | -14 |

| ITALY (100) | 126/136 | 131/141 | 1 | -3 |

| NETHERLANDS (25) | 34/38 | 38/43 | 0 | 0 |

| NORWAY (25) | 15/19 | 18/22 | 0 | -1 |

| PORTUGAL (100) | 190/200 | 180/200 | 15 | 25 |

| SPAIN (100) | 146/156 | 140/160 | 10 | 14 |

| SWEDEN (100) | 32/36 | 35/39 | 0 | -2 |

| UK (100) | 73/77 | 77/81 | 1 | -3 |

| USA (25) | 35/41 | 39/45 | 0 | -4 |

The unfortunate thing about credit problems are that they never seem to go away….unless you fix the underlying issues (balance sheet, spending, revenue) !!!

WIZ

From : Michael Panzner

From : Michael Panzner Can anybody tell us where is the V Recovery that Mr. Market is discounting ??? Please give us a break !!!

Can anybody tell us where is the V Recovery that Mr. Market is discounting ??? Please give us a break !!! La confirmación de la DEATH CROSS ( 50MM/ 200MM) hace preveer que en España se avecinan problemas

La confirmación de la DEATH CROSS ( 50MM/ 200MM) hace preveer que en España se avecinan problemas

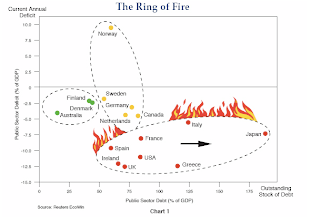

Great analysis from PIMCO ( Bill Gros ) of Reinhard/ Rogoff ( This Time is different) book and its implications for countries...

Great analysis from PIMCO ( Bill Gros ) of Reinhard/ Rogoff ( This Time is different) book and its implications for countries...

FALLING OFF A CLIFF !!!

FALLING OFF A CLIFF !!! BANK CREDIT STILL CONTRACTING

BANK CREDIT STILL CONTRACTING